Personal Finance & Investing

Reading time: 1 hour

Lifetime value: $10,000 (or more!)

- If I sat you down and promised to pay you $10,000 after you finish reading this primer on personal finance and investment, I’m sure you’ll do it right now.

- If I convinced you that by reading it, you’ll make at least $10,000 over your lifetime, you’ll do it as soon as you have an hour or two to spare.

But I can’t.

So I’ll just hope you see its value – and do the smart thing!

Many posts on this blog can be directly or indirectly attributed to my daughter. They are about conversations we’ve had, or things I’ve tried to teach or explain to her.

This is one more of them.

Over three weeks, I gave her and some friends 6 lectures of 90 minutes each. In them, we covered the basics of personal finance and investing. The youngsters loved it.

And that is now taking the form of this really long, really detailed and really helpful article.

(There are also my books – ‘The Emotion Prism‘, ‘Heart, Guts & Steel‘, ‘47 Hearts‘ and ‘The Icedrop‘.

Because you, too, might benefit from this information.

I hope you do.

And look forward to hearing from you after you’ve finished reading… which I expect will take you quite a long, long time!

Onwards…

Personal Finance & Investing : A Strategic Philosophy

I’m calling this section a strategic philosophy and starting with it because like any other complex, tangled and elaborate subject, personal finance and investing also requires a bird’s eye overview of the landscape to make better sense of the smaller details.

If I plunge right ahead into a description of asset classes, or technicalities of stock trading, or the methods to evaluate a business or investment, you might follow along just fine… but won’t have the perspective necessary to put it all into the correct context.

On the other hand, if I set the stage with a broader overview of what investing and personal finance is all about BEFORE getting into the nitty-gritty details, I believe you’ll be able to make better use of all the information I’m about to overload you with soon.

So if it seems as if this is all moving ahead too slowly for your liking, or you feel like I’m beating about the bush without quickly getting to the point, please bear with me.

There’s method to this madness. Trust me!

3 Principles of Financial Freedom

You’ve probably heard the term bandied about.

Financial Freedom!

It has a nice ring to it, right?

Sure.

Because all of us long to be ‘free’.

- Free to do what we want or like.

- Free to live anywhere and go everywhere.

- Free to think, speak and act according to our will.

And with money being at the heart of many (if not all) things we do, financial freedom underlies most of these other kinds of freedom.

So let’s begin by listing three essential principles of achieving financial freedom.

It’s simple, really.

1. Live within your means

2. Save regularly

3. Invest wisely

What?

That’s it?

Yes.

As astonishing as it sometimes seems, the most difficult-sounding things have really simple solutions. And these 3 principles alone will bring you financial freedom.

Of course, there are several steps along the way… and we’ll go into each of them in detail soon.

But to make sure you have a solid foundation, let’s explore each of these 3 principles at greater depth.

1. Live Within Your Means

It sounds glaringly obvious, yet most people don’t do it.

We could blame several things for this. A lack of awareness. The temptations of compelling advertising. Easy access to credit through cards and loans.

But in the end, it boils down to one thing – a lack of financial discipline.

By the time you’re through studying this report, I hope you’ll understand this concept better – and determine to develop it, so that this becomes one of the pillars to build the structure that will make you financially free.

P.T.Barnum, the famous 19th century showman who turned the ‘Barnum & Bailey Circus‘ into a worldwide phenomenon, wrote a brilliant book about personal finance way back in 1880.

It’s called “The Art of Money Getting; Or, Golden Rules for Making Money” – and one of his famous quotes in it is:

“To have annual income of twenty pounds per annum, and spend twenty pounds and sixpence, is to be the most miserable of men; whereas, to have an income of only twenty pounds, and spend but nineteen pounds and sixpence is to be the happiest of mortals.”

Think a little about this quote before you move on.

It truly doesn’t matter how much you earn… if you don’t learn to live within that income, you’ll eventually be miserable.

So practicing the art of living within your means is vital to your journey in search of financial freedom.

2. Save Regularly

I will reiterate this often over the course of this article, because it is easily one of just 5 big takeaways from it.

If you get into the habit of saving five dollars or fifty rupees or two euros EVERY DAY, at the end of a month you’ll have a chunk of cash to invest in something.

If your saving is more random and whimsical, socking away a bit every now and then, chances are better than not that you’ll have just a little to invest… and will not be very excited about doing it.

Like any good habit, it takes time and effort to develop. And like any other good habit, the benefits from this practice will last you a lifetime – even beyond!

3. Invest Wisely

As you’ll learn in a while, saving money alone will not make you rich or financially free. To accomplish that, you must also invest your savings… wisely.

Of course, without saving you won’t have anything to invest. So both things go hand in hand.

Investing is the act of putting in something to – hopefully – take more of it out.

- You may invest energy into planting a field, and get a yield of crop from that effort.

- You may invest time into educating a child, and get a well-read, pleasant-mannered adult as a result.

- You may invest money into assets, and get a larger asset or greater value for doing it smartly and wisely.

How to invest wisely?

That’s exactly what we’re going to discuss next. And it begins with…

The Story of Money

Money first came into existence as a medium of exchange.

Meet farmer John.

He grows tomatoes. Daily he toils in his little patch of land, where he plants and grows the vegetable.

When he harvests produce, John’s family feasts on different tomato recipes.

It’s nice. But also boring.

I mean, after a while, tomatoes get boring, right?

How would it be to eat something else instead, he wonders.

So one fine day, John sets out to visit his neighbor –

Farmer Peter

Peter grows potatoes, not tomatoes.

So John carries along with him a bagful of tomatoes – which he offers Peter in exchange for a sack of his potatoes.

Now farmer Peter, who frankly had become fed up of eating just boring old potatoes, welcomed the chance to add variety to his diet.

The farmer neighbor happily made a trade.

Things were well for some time.

But soon, both farmers grew bored of having just two options – potatoes, or tomatoes.

“Let’s visit my friend, Jill” suggested Peter. “She lives in the next village, and grows cabbages.”

So carrying a bag of tomatoes and potatoes each, they trudged to the next village. Finally they arrived at

Farmer Jill’s place

And there, they swapped their vegetables… for cabbages.

This arrangement works just fine… except for its inconvenience!

What if, instead of lugging a sack of vegetables, the two farmers could offer Jill something equivalent –

- Like a handwritten note?

- Or even a piece of colored paper?

Something that she would accept for her cabbages… under the condition that when she later presented that note or paper to John and Peter, they would give her produce of the same value in exchange.

And that’s how money came into existence.

As a medium of exchange of value.

But…

What Exactly Is ‘Value’?

In the case of John, Peter and Jill, the vegetables they grew are ‘value’.

To another person, what they grow, build, do or create can be ‘value’.

In other words…

Economic Activity determines the value of money.

In any society, community, city or country, there are different kinds of economic activity going on.

Broadly, we can group them under 4 heads:

- Primary economic activity is the production of raw material, like growing agricultural products or mining minerals.

- Secondary economic activity deals with manufacturing or construction.

- Tertiary economic activity is delivering various services, like being a nurse, or a fireman, or a plumber.

- Quarternary economic activity comes from applying highly specialized knowledge to create value through technology or support.

All these types of economic activity add value to people and the environment… to a varying extent.

Money, as a token that represents this economic value, grows in value whenever there is plenty of economic activity going on.

In the same way, whenever economic activity stalls and slows down, the value of money decreases.

So the key takeaway from this story is to understand that money has little if any inherent value, in and of itself.

Money derives its value only from the ECONOMIC ACTIVITY behind it.

And whenever there isn’t much economic activity going on, money drops in value – a condition called ‘devaluation‘. Under such conditions, your money will be able to purchase less.

The reason is because any transaction involving money is an exchange of value.

So if your money has lesser value, you’ll have to spend more of it for the value you seek.

Clear?

Next, let’s talk about how this value of money is determined.

Introducing: The Gold Standard

In the good old days, countries printed (and minted) their own money.

How much money could they print?

By convention and mutual agreement between nations, it was agreed that…

It depends on how much GOLD they own.

The ‘gold reserve‘ was held in the form of bullion (gold bars or coins) in the vaults of federal/central banks… and an equivalent amount of currency was printed for circulation.

The value of each note or coin used in transactions was BACKED BY the value of gold in the bank vaults.

This was called the ‘gold standard‘.

Things changed globally around the time of the Great Depression – and several countries chose to go off the gold standard. They decided that the amount of currency and coins they released would NO LONGER be linked to physical gold held in their federal/reserve banks.

One of the last countries to go off the gold standard was the USA – in 1971.

So what has replaced the gold standard… and how does this new system work?

Enter: FIAT Money

fiat – “a formal authorization or proposition; a decree”

So ‘fiat money’ is money that is created by an order of the government.

It comes into existence with literally NOTHING to back it – and then derives its value from what people are willing to pay for it!

Go back and re-read that sentence again.

And again.

Because it is kind of confusing – yet lies at the heart of much of what you’re about to learn.

Fiat money has no inherent value, and is NOT backed by gold reserves in a nation’s bank vaults. Instead, it derives its value from something we’re already familiar with…

Economic Activity.

Remember how our farmer friends – John, Peter and Jill – created value by growing vegetables?

And how they exchanged the value that each of them generated – through the medium of money?

Fiat money does exactly the same thing… with one difference.

While the value of the money our 3 farmer friends exchanged between each other was arrived at by mutual negotiation and agreement, the value of fiat money that is used across an entire country is determined by the overall economic activity of the nation.

For example, imagine that you live in a tiny country with only 100 residents – with their economic activity spread out across the 4 categories we discussed earlier.

Let’s say the government of this little nation prints a total of 1,000 currency notes. That’s it. Only 1,000 notes in all.

What is each note worth?

It depends upon what the 100 residents do!

Let’s imagine that, collectively, these 100 residents generated economic activity worth 100,000 units.

Then each currency note in circulation will be worth (100,000 divided by 1000) or 100 units.

(In India, these units are called ‘rupees‘, in the US they are ‘dollars‘ and in Europe, ‘euros‘… just different names to refer to a basic unit of money.)

Does this figure for ‘value’ remain static?

Of course not!

If, for some reason, 50 of our 100 imaginary nation’s residents suddenly became unable to work, economic activity would stall. Total productivity drops from 100,000 to just 50,000 units.

Now the VALUE of each currency note in circulation drops… to half of what it used to be.

So a note is worth only 50, and not 100 units!

The opposite effect would happen if productivity grows due to increased economic activity in the country.

In case that still sounds confusing, scroll back up a few screens and read this again carefully.

VALUE of a currency (or ‘money’) is determined by a country’s economic activity.

If such activity is high, the money has more value. If the economic activity is low, the money loses value.

Now, if you’re hearing about this concept for the first time ever, you’re probably scratching your head and wondering…

But – What is my money really worth?

And the shocking answer is: NOTHING!

In and of itself, ‘money’ is just printed bits of colored paper, and funnily shaped disks of metal.

Throw your mind back to Tuesday, 8 November 2016. On that day, at around 8 PM, by a simple announcement to the citizens, India’s currency was INSTANTLY rendered worthless – and replaced by new currency notes.

That’s all ‘paper money’ (or, indeed, any form of money) really is.

- It is issued by government order – hence ‘fiat money’.

- Its VALUE comes from the ECONOMIC ACTIVITY that backs it.

- And the money is only WORTH whatever you can exchange it for!

Hold this principle firmly in mind during our discussions about investing.

Now…

How Does Any of This Matter?

It doesn’t… most of the time.

Except when you’re trading with other countries who use different currencies!

At that point, it becomes important to estimate what our money is really worth.

If, for example, the United States has far higher economic activity than India, their currency unit (a dollar) would have more value than our unit (a rupee). At today’s rate, a dollar is worth nearly 70 rupees.

So whenever goods or services are traded across national borders (international trade), determining the value of our money helps achieve a ‘fair exchange‘ between trading partners.

But… but… but…

HOW can we possibly estimate how much a country is producing economically?

Should we run elaborate calculations with a super-computer each time we spend our money abroad, or do international trade deals?

Not really.

Because, remember what I told you awhile back?

Money is only WORTH whatever you can exchange it for!

And in international transactions, the rate of exchange (which depends upon the value of your currency, and that of your trade partners) is often a matter of mutual negotiation.

Yes, just like Farmer John and Peter decided the relative value of a bag of potatoes and tomatoes.

Imagine how that transaction would work if, for instance, John felt it was twice as difficult to grow tomatoes as potatoes.

John would insist that his bag of tomatoes should be worth TWO bags of Peter’s potatoes.

Peter might agree – or not.

If he doesn’t, he’d haggle… and point out that growing potatoes was also hard work, and at most, he’d settle to exchange a bag of John’s tomatoes for one and a half bags of potatoes.

When both agree, they have a deal – and carry out a transaction.

Pretty much the same thing happens in international transactions, where the relative value of both nations’ currency is negotiated between traders.

And because literally MILLIONS of such transactions happen around the world every hour, the price range between which any currency is valued remains pretty steady – and reflects the country’s economic activity with a fair degree of accuracy.

Of course, national economic productivity figures of a country are available for economic analysts to study, in the form of GDP and other measures of activity.

And the number of legal (non-counterfeit!) currency notes in circulation is also a matter of public record.

So it is indeed possible to compute a rough estimate of what a country’s currency is worth, in terms of the economic activity underlying it.

But eventually, when it comes to trades and transactions…

The VALUE of your money is determined only by WHAT YOU CAN EXCHANGE IT FOR.

That’s what your money is really worth.

Quick Recap

To summarize what we’ve learned until now about money…

- governments print currency

- value depends upon economic activity

- exchange rate is a matter of negotiation

With this foundational concept in mind, you’re now ready to dive deeper into the principles of personal finance – and start planning the framework of your investment empire, to prepare for your financial freedom!

Onwards…

INVESTING – What is it? Why does it matter?

Investing is putting something in – to get MORE out of it.

In a financial sense, it means putting your money into one or many investments with the goal of getting back more money after some time.

Is investing the same as saving?

Well, yes… and no.

My grandma would save some of her money leftover from household expenses – and kept it locked up in a wooden chest in her bedroom.

My aunt would spend her monthly budget judiciously, and save a portion of it – which she stored inside a biscuit tin in her kitchen.

They both ‘saved’ money.

And they kept their saved cash close at hand. This was for two reasons – safety/security, and easy access whenever they might need it.

The problem with their kind of ‘saving’ is that the value of the money they put away DECREASES over time.

How does this happen?

I’m glad you asked. Because I’d like to introduce you to another concept that’s a force which acts in an opposite direction to investing… called

INFLATION

At a later stage, we’ll get into the role of inflation as an important lever of monetary policy that drives economic activity.

But the basic idea of inflation is simple.

Inflation progressively lowers the ‘purchase power’ of your money. In other words, when inflation is at play, things become more expensive over time.

This leads to your money becoming LESS valuable in the future than it is today.

Say you have 1,000 rupees to spend now.

If you put off your spending by one year and the rate of inflation is 5%, then 12 months later your 1,000 rupees will only be able to buy you stuff that’s worth 950 rupees today.

Your money went DOWN in buying power – by 5%.

Another way to state this is:

You’ll pay 1,050 rupees to get the same things a year later.

Once again, your money went DOWN in buying power – by the rate of inflation.

We’ll talk about how and why this happens a little later on. But for now, just understand that:

Your money LOSES purchasing power – thanks to inflation.

Why does ‘inflation’ matter when we discuss investments?

Because my grandma and aunt thought they were ‘saving’ money by stashing it away in the house. But actually, their money was gradually becoming worth less and less over time – thanks to inflation.

They could buy less – or had to pay more – in the future.

If they had saved AND invested the money, it would have increased in value despite inflation – so they actually would have had more money to spend in the future.

That’s why you should learn how to invest.

Of course, you must also learn how to save money first, because otherwise you won’t have any to invest.

But once you have some cash to spare, investing it can grow it into a larger asset over time.

So this is your first MAJOR LESSON in investing money. You should…

Invest to Beat Inflation

For this, you must understand two aspects of investing that will govern your decisions.

1. Return on investment (or R.O.I.)

2. Risk

Return on Investment

R.O.I. means what you’ll get in return for your investment.

Take the simple case of investing 1,000 rupees by depositing it in your bank account.

If the bank pays you an interest of 4% per annum, at the end of the year you’ll earn 40 rupees – in addition to having your original investment.

That is your “return on investment” – or ROI.

Two things affect your return.

1. Interest Rate

This is what your bank promises to pay you in exchange for letting them have your money in a deposit for a year – a kind of ‘rent’ they pay you for your money.

The higher your interest rate, the larger your R.O.I. If your interest rate was 8% instead of 4%, you’d earn 80 rupees instead of 40 in a year.

2. Taxes

What your bank pays as interest on your deposit becomes part of your income – and is subject to Income Tax.

If you have to pay 20% as income tax on your earnings, that’s 8 rupees out of your 40 rupees interest earned… leaving you with a post-tax R.O.I. of only 32 rupees.

So your post-tax ROI is 32/1000 – or 3.2%, not the 4% you might have expected.

Interest rate has a POSITIVE effect on your R.O.I. – and taxes have a NEGATIVE impact on your R.O.I.

While choosing between different options, these are the variables to consider before you put down your money – along with the other critical component of any investment, which is your…

Investment Risk

My professor was a sportsman who enjoyed betting on horses.

One weekend, he bet on a Triple Jackpot – and picked all 3 winners correctly. His ‘investment’ of 50,000 rupees earned him a return of 350,000 rupees – in just 48 hours!

Why isn’t this a good investment strategy for everyone?

Because the RISK from his approach is extremely high.

The chance of winning a Triple is very, very low. The possibility of losing your entire stake is really high. That’s why it is called… gambling!

So before you get carried away by the attraction of a high ROI, consider the risk – and decide whether it’s worth the return.

There are two kinds of risk in an investment.

1. Credit Risk

Remember how my grandma and aunt kept their cash at home?

They did it because it would be safe. As long as a burglar didn’t break in and steal it (or one of my nosey cousins locate the stash), the money would be there.

Credit risk is the possibility that your cash may NOT be available when you need it!

What do I mean?

An individual or institution in which you invest money might disappear, or go out of business, or run into bad times… and be unable to pay you back.

Not only could you lose your interest, you might even lose all (or part of) your capital.

This is called Credit Risk.

2. Interest Rate Risk

Even if your capital is safe, the economic climate might change to the point where the person or company or bank you invested in alters the terms of your investment.

So instead of paying you 8.5% on a deposit, for example, the bank may declare a lower interest rate of only 6%.

Your ROI drops sharply!

This is called Interest Rate Risk.

All investments carry a risk of some kind. And broadly speaking, your return parallels the risk.

No risk, no return.

If you seek a higher return, you should be willing to accept a bigger risk.

Balancing risk against return is the essence of intelligent investing.

Now that you’re familiar with the ideas of

- inflation,

- interest rates,

- taxes,

- return on investment and

- risk,

we can move ahead to more detailed analyses about your investing choices.

But before that, you should know about just one more fundamental concept.

This one’s a doozy!

And I’ll bet it will make your head spin!

How Is Money Created?

No, not ‘currency‘ – but MONEY.

It’s amazing how only few of us have thought deeply about this, even though money is something we all use – literally every day!

So let me take you through an example of how money is created.

Pay close attention to this section – because it is fascinating, but also potentially a bit weird and confusing in the beginning.

Ready?

Imagine that you borrow 100 rupees from me. In exchange, I get you to sign a letter that promises to pay me back the 100 rupees – by next week.

In case you didn’t notice…

I just CREATED money!

How?

Think about it.

You have 100 rupees in your hands. And I have your letter – which is worth ANOTHER 100 rupees!

I created 100 rupees – from nothing!

Not sure how that works?

Let me explain.

Look at what happens next.

- You’ll take the 100 rupees out and spend it.

- And next week, you’ll come back to me, return 100 rupees that you borrowed – and take back your signed letter.

In other words, by having you sign a letter (called a Promissory Note, or I.O.U.), I CREATED new money – that didn’t exist before.

Still think I’m pulling a fast one, trying to flimflam you?

Well, look at it this way.

After you borrowed 100 rupees from me and left, if I were to take the signed letter you gave me to my neighborhood grocery store – and asked them to accept it instead of money… as long as the shopkeeper knows and trusts me to be telling the truth, he may agree.

The letter you signed has VALUE – just as if it were real money!

In fact, this is exactly how things work in the world of money.

Our paper currency is actually nothing but a signed note… one that’s guaranteed by the government.

If you pull out a bill from your wallet or purse and look at it, you’ll see the words: “I promise to the pay the bearer the sum of…” printed on it.

Yes, the currency notes we use every day are just a ‘signed letter’ promising to pay whoever holds it in their hand.

Instead of the shopkeeper having to trust me, he can trust the government – which guarantees payment against the signed letter!

So if that’s how money is created, then in the real world…

Who CREATES Money?

An obvious answer might seem: The Mint.

After all, that’s where currency notes are printed, right?

But that isn’t the same as “creating money”.

This task is the preserve of…

COMMERCIAL BANKS.

- You probably have a bank account into which you deposit your savings. It collects money from you and thousands of other customers.

- Your bank also lends money to people who need it, and charges borrowers an interest for ‘renting’ the money.

- Within a mutually agreed upon period, borrowers should return the money back to the bank – along with the interest rate charged.

- Borrowers may be business owners, service providers, and anybody else whose productivity will boost the economy through the manufacture of products, or by providing services.

Now here’s the magic of how banks create money.

When you deposit 1,000 rupees with your local bank, your bank is permitted to lend MORE THAN 1,000 rupees to borrowers. In fact, your bank can loan out a MULTIPLE of its total deposits!

By doing this, the bank creates money – out of thin air!

Surprised?

I was when I first learned of this.

Does this mean a bank can lend as much money as it wants to?

Of course not!

Remember how the VALUE of money depends upon economic activity backing it?

If banks create too much money, its value will drop – because the same economic activity now has to support a larger amount of it.

That’s why the central bank places limits on a commercial bank’s lending capacity.

Your bank can only hand out loans in proportion to its own assets (this is called “capital requirement ratio (CRR)” or “capital adequacy ratio“) so that no bank stretches itself out too thin.

So to make it clear – while you deposit only 1,000 rupees, if the CRR is 5, your bank may (on the strength of your deposit) lend up to 5,000 rupees to diverse borrowers – but no more than that.

And that’s not all.

Your bank can even charge an interest to borrowers on the amount loaned.

Ok, so let’s briefly recap what we’ve learned…

- Money is a medium of exchange whose value is determined in proportion to economic productivity and market demand.

- Money is created through the act of requesting it (‘creating demand’) for a particular economic purpose.

- It is created by banks, who lend more money than they actually collect in the form of deposits.

- The “new money” that’s created now enters the financial system.

- It is later paid back by borrowers – out of economic activity that they engage in using the loan.

Even if this sounds a little confusing, you’ll ‘get it’ once you play around with the idea.

At first, it may just come as a shock – because this clearly isn’t how we’ve thought about ‘money’ before.

But as an intelligent investor, you must understand the tools of your trade.

And money is the most fundamental of those.

Next, let’s look at how that money flows… how it is controlled and managed… and how it is used.

Understanding Monetary Policy

Regulation of money within a country is often the responsibility of a government or constitutional body.

In India, monetary policy is controlled by the central bank (Reserve Bank of India, or RBI).

The RBI’s monetary policy controls:

- supply of money

- availability of money

- cost of money (rate of interest)

The goal of monetary policy is to manage:

- economic growth

- international exchange rates of money

- unemployment

- inflation

While it is fascinating to learn about how this happens, much of it falls outside the domain of our discussion – which is about personal finance and investing.

So let’s focus on the two areas which are most relevant to it.

- interest rate

- inflation

One of many critical responsibilities of Central banks is to control HOW MUCH MONEY enters the economy.

The tool they use for this is the Interest Rate.

- When the RBI makes money available at lower interest rates, borrowers are more likely to borrow for business expansion.

- Businesses increase production, build more factories, acquire more equipment, and create larger infrastructure.

- They hire more people, increase employment rates, and pay higher salaries.

- This, in turn, raises income levels for more people, who now have more money to spend.

- They consume more goods and services that are created by businesses, boosting demand for even more.

There’s a positive upward spiral.

The economy grows.

And as we’ve seen before, money becomes more valuable and currency gets stronger.

Strange and paradoxical as it might seem…

Spending makes us citizens poor, but governments rich!

But Central banks can go too far with this.

Left unchecked, low interest rates encourage businesses to borrow even for unnecessary expansion in business. After all, the cost is so low – so why not build an extra factory, even if there’s no clear demand for more products?

But look at what happens if they produce more than the market demands.

- Employees, who now have more money to splurge, are willing to pay higher prices for things they want.

- Price becomes disconnected from value.

- An economic bubble is set up. And slowly, it grows bigger.

- Inefficiency creeps into the system.

- Money is plentiful – but its value drops.

The result is…

INFLATION.

Purchasing power of currency drops. The same commodities now cost more. The economy becomes ‘over-heated‘.

Eventually, the central bank may act.

Remember, it still controls the levers.

It can raise Interest Rates.

This makes it more expensive to borrow. So businesses stop all but the most essential activities.

Money supply drops across the economy.

Gradually, efficiency returns to the financial system.

Inflation is controlled.

In summary:

- Whenever interest rates go down, inflation will spike.

- When interest rates are hiked, inflation will fall.

Because the role of a central bank in wielding these tools is critical to any economy, central banks are given a high degree of independence from political and government interference.

In India, the RBI is empowered to make independent monetary policy decisions, guided by the country’s overall economic well-being.

And it nudges the economy in a particular direction.

Does this always work?

Well, usually.

And for when it doesn’t, there’s another set of economic levers held by the government – which makes up Fiscal Policy.

But enough of the ‘boring’ stuff.

Let’s get on with the more exciting purpose of making a lot of money through investing.

And that conversation starts with an introduction to

ASSET CLASSES

What Are Assets?

In its simplest form, an asset is what puts cash in your pocket.

How does an asset make you money?

- It could be something you can lend or rent to a friend, for a fee.

You could deposit it in a bank, and be paid an interest. - It might be an item that will increase in value over time.

You may choose to own what others will pay a lot for in the future.

In whatever manner it happens, an asset will end up bringing you more value.

By contrast, a liability is something which will cost you money or decrease in value over time.

Broadly, assets may be grouped into two formats:

- financial assets

- physical (or ‘real‘) assets

What are financial assets?

They are intangible things – with no actual physical shape or form – that you can still lend to others, or profit from in different ways.

For example

- Cash or bank deposits are financial assets. They can be loaned to others, who will pay you an interest (a form of ‘rent’) to use your money (asset).

- Corporate and government bonds are financial assets. You can directly lend money to companies or the State, who pay you a ‘rent’ on your money.

What are physical assets?

They are tangible things – actual products or stuff you can touch and hold – that will increase in value, or earn you money in other ways.

- For instance, you can own (or buy a share in) real estate, like a residential or commercial property that will go up in value.

- You may invest in precious metals like gold or silver. Or buy a piece of art that will become more valuable as the artist becomes famous.

You may even borrow financial assets to invest in physical assets!

Debt And Equity

As an investor, you may choose to invest in either of the two broad categories of assets.

- An investment into financial assets is called a ‘Debt Investment‘.

- An investment into physical assets is called an ‘Equity Investment‘.

So if you hold your savings in cash, or deposit it in a bank to earn interest, you’re investing in a financial asset… or making a DEBT investment.

If you use your money to buy a property, or take a stake in a company, or hold stocks of a commodity, you’re investing in a physical asset… or making an EQUITY investment.

We’re going to

- dive deep into each of these asset classes,

- understand what makes each of them good options to invest your money into, and

- learn how to pick one over another to match your unique investment targets and horizons.

But before doing that, we’ll quickly look at a bunch of human factors that are special and individual to YOU… and which will have an outsize effect on the kind of investment decisions you’ll make.

Personal Finance Is About Personal & Emotional Factors

If we were all cold, logical, calculating intellectual robots, we’d probably make far better investment decisions – but become much less human in the process.

Thankfully, we’re warm-blooded, hot-headed, irrational and emotional beings, driven by a curious combination of fear and greed, to make sometimes brilliant and sometimes silly decisions with our money and investments.

It’s important to acknowledge these quaintly endearing characteristics of our personalities… because they’ll help you be more forgiving and tolerant of your investing mistakes!

After all…

To err is but human.

Here are just some personal traits, feelings and emotions that will guide and drive investment choices:

Greed

If you’ve seen the movie ‘WALL STREET‘, you’ll remember Michael Douglas’ famous words as the ruthless investor Gordon Gekko:

“Greed is good!”

Well, you may or may not quite believe that – but greed IS indeed an emotion that drives investment choices.

At a very basic level, it is our very reasonable greed to have more money than we currently do that makes us want to invest it sensibly… and keeps us learning about how to invest smartly.

Appetite for Risk

Without wanting to scare you unduly, investments do carry a small risk.

You may lose out on getting a decent return on investment (R.O.I.). And rarely, you may lose a part or whole of your investment capital itself.

How willing you are to lose money (and how capable you are of doing so) will in turn govern the investment decisions you will make with your money.

Investment Horizon

This is simply the period for which you are investing. It may be as short as a few months to a year. Or it may be as long as 10, 15, or even 30 years.

Broadly speaking, a longer investment horizon gives you greater opportunity to get higher R.O.I. than a short-term one.

But your investment horizon will depend upon various other factors – and when you expect to need the money you’re investing today.

Discipline

Earlier, I mentioned the need to save regularly as being one of the 5 biggest takeaways from this really long report on investing and personal finance.

Well, at the heart of that lies your personal investing discipline.

If you can discipline yourself to invest on a plan, you will reap rich rewards – just as long as you choose the right plan. But without financial discipline, even the best investment plan and stock picks will not make you rich.

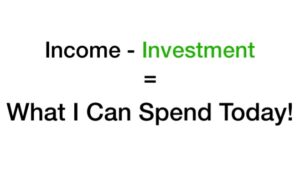

Defer Gratification

Plainly, this means giving up something now – to enjoy something bigger in the future. You say ‘No’ to a smaller pleasure today, because you’d like to experience sheer ecstasy tomorrow.

Why does this matter in personal finance and investing?

If you choose to indulge yourself in all your desires right now, then a large share of your income (salary, savings, gifts, investments, etc.) will go towards your expenses… leaving a smaller surplus to invest for the future.

This means, even with a great investment plan, your smaller capital will only earn you less money in the future.

On the other hand, if you choose to defer gratification, then you will be able to allocate a certain proportion of your earnings to invest for the future – and use only what’s left for day to day spending.

Over time, this grows your investment capital steadily – and when combined with a powerful growth plan for your wealth, will take you confidently towards the dream of financial freedom.

Frugality

Some people won’t spend much, no matter how much money they have.

Others can’t seem to stop spending, even when they don’t have a lot of cash.

Frugality helps you invest a bigger share of your income – which in turn grows the value of your investments bigger, and faster.

So a frugal investor might achieve financial freedom in 10 years… while a spendthrift might take 15, 20 or even 25 years to get there.

Income or Value Growth

Investment goals and targets differ from person to person.

Some might want or need a steady flow of income from their investments.

Others may prefer steady increase in value, even if there is no regular income from the investments.

Time Available

- You may be at mid-career and dream of retiring by age 45 – leaving you 15 years to attain financial freedom.

- Or you may just be starting out, and have a good 25 to 30 years to arrive at your investment goals.

- Or you may be near retirement, worrying about saving up a nest-egg for the post-job years.

The investing decisions you make will be guided by how much time you have available.

Everything else being the same, a longer time frame puts less stress on you as an investor. Also, you won’t have to take bigger risks.

Interest and Aptitude

These are purely individual traits. The fact you’ve read so far into this report suggests you are indeed interested. And if you have the aptitude for investing, you can make choices that are right for you.

On the other hand, if you’re not eager to learn, or simply cannot figure this stuff out, you can still be a good investor – by seeking help from an expert.

There are many skilled professionals who can guide you, or even handle your investments based on your needs for a modest fee.

Ability to Learn – And Work at it

We’re all learning. Nobody knows it all.

Even top investors make mistakes, and learn from them. Warren Buffett, one of the world’s most successful investing mavens, says he lost a whopping 50 BILLION dollars in bad investments – just a couple of months into the COVID-19 pandemic driven market crash!

So clearly you can’t expect to read this report, make up your mind, plunk your cash on a few stocks and deposits… and then become enormously successful in a few months or years.

No, that isn’t how this works.

If you’re

- willing to learn,

- keep refining your investing skills,

- take modest risks,

- learn from the experience,

- continue to work on improving steadily

then you’re practically guaranteed to succeed.

That’s why I said personal finance and investing is PERSONAL.

Your goals and dreams, targets and attitudes, risk appetite and choices will be entirely different from mine – and any other investor.

And that’s okay.

It is called PERSONAL finance for a good reason.

Alright.

Now let’s get to the core of investing – and talk about…

HOW TO PLAN YOUR INVESTMENTS?

Whenever you start planning your investments, there are 3 questions to address:

- Where to invest?

- How much to invest?

- How to invest?

And the answers to these questions will depend on a very important balance in…

Risk vs Return

You’re already familiar with these two terms.

We’ve discussed different kinds of risk, like credit risk and interest rate risk.

And we’ve talked about return on investment, along with the factors influencing it – like interest rates, taxes and inflation.

Now it’s time to link them together.

Risk and Return go hand in hand.

- Whenever you take a bigger risk, you can expect to earn a higher return.

- Also, if you’re seeking higher return, you must be willing to accept more risk.

Think of it as an adjustable tuner… when you twist the knob towards more risk, the chances of winning big with your investment go up.

But does that mean you should take crazy risks?

Well, that depends.

Some folks are like this guy, willing to jump off a cliff… with nothing but a giant rubber band to keep them from crashing to the ground.

I would never do that.

Yet thousands of people seem to enjoy it.

So you may be happy to take dangerous risks.

Or you may be like me – and shy away from doing stuff like that.

It depends upon your:

- Risk Appetite or Attitude – which is an emotional attitude towards risk. Would you worry if you lose 30% of your wealth? No? Your appetite for risk is high.

- Risk Capacity – which is a physical reality that depends upon your circumstances.

What are your income needs?

If you have enough money to cover them, you may be able to take bigger risks. But if you don’t, your risk capacity is limited.

So take a minute to ask yourself:

- what is my risk appetite?

- what is my risk capacity?

Your Asset Allocation Strategy

If you are risk AVERSE (and can’t or won’t take risks with your money), then debt investments are a good choice – because you’ll enjoy a steady R.O.I., even if it’s a bit smaller.

If you’re willing and able to take a little risk, then equity investments will sound more appealing – because of the potential to rack up huge wins if your bets pay off.

But regardless of your risk profile, understand that investing all your money in either debt or equity alone isn’t a great idea.

If you’re invested 100% in debt, the drawbacks are:

- Lesser R.O.I.: Your earnings are always subject to Interest and Taxes.

- Fixed return: No matter how hard you try, you can’t get a higher R.O.I. when interest rates are low and fixed.

- Income is taxable: Taxes apply to earnings from debt investments, further eating into your R.O.I.

Things aren’t much better if you’re invested 100% in equity.

The uncertain and irregular earnings from stocks can lead to your investment journey becoming a bumpy roller coaster ride, with exciting thrills mixed with terrifying lows.

That’s why most investment advisors and consultants recommend that you diversify your investment capital between both debt and equity.

How much should you invest in each group?

The younger you are, the more you should invest into equity with its potential for a higher R.O.I.

A simple rule of thumb is:

100 – Age in years = % in equity

So if you’re 25 years old, then (100-25) = 75% of your investment capital should go to shares and other equity investments.

The reasoning behind this formula is that young persons have

- a smaller corpus of savings – and so the pain of loss isn’t quite as crippling

- fewer people dependent on them and can absorb losses better

- no expensive commitments, like a child’s education or marriage

- plenty of time – even if there’s a set back, they can wait patiently for things to turn around

If you pick your investments well, even if the value of your portfolio falls during an economic downturn, you can wait for the business cycle to improve.

An upswing that follows a crash might even earn you a windfall profit!

Still, this isn’t to say that if you’re young, you should rush in and put all your investment capital into shares and other equities.

Start slow, with no more than 30% in equity in the beginning.

As you learn more and grow comfortable investing in equity, steadily increase this until you reach the right proportion.

Also keep in mind that, in addition to the proportion of your money that you invest into each asset class, there’s another major factor that defines your R.O.I. and that’ is…

Your Investment Horizon

What return you might expect from an investment often depends upon how long you can hold it.

If a bank deposit pays 7% interest every year, it’s obvious that you’ll earn more money from it by holding for three years than if you withdraw cash after one.

On the flip side is the purpose for which you are investing in the first place.

You may need the money for something else, and can’t leave it invested. That limits your investment horizon – and indirectly impacts your R.O.I.

An intelligent investment plan should consider:

- when you will need your money back, and

- how much of it you will require

This investment horizon will then, in turn, guide your choice of asset class and specific type of investment to put your money into.

So, let’s pause for a brief recap:

- We’ve talked about risk versus return

- We’ve discussed asset allocation

- We’ve looked at your investment horizon

In my lecture series (upon which this report is based), I rushed right ahead into an explanation of the various debt and equity investment options available – before giving my students a little homework assignment.

Only after everyone submitted their reports, I realized my mistake.

While I had told them to “define your dream, then plot your course”…

There Was An Important Piece Missing!

What was this missing piece?

You don’t yet know how much RETURN you want from your investment.

And I haven’t taught you this crucial component to investing.

Without this, how can you plan your portfolio allocation?!

You can’t.

That’s why we’re going to talk about that next – before diving into the various investment opportunities available to carry you to ‘financial freedom’.

What Return To Expect From Your Investments?

There are as many different investment plans and strategies as there are people on this planet!

Each of us is unique and different. And that’s beautiful, because if we were all the same, thought the same way, did the same things… life would soon become boring.

Even with investing, individuals act and think differently.

There’s no ‘right’ or ‘wrong’ way – just YOUR way.

So don’t feel limited or constrained by anyone else’s approach. Follow your heart.

Your idea of a plan may be simply to experience things without a definite goal or end point.

Or it may be more carefully plotted. You know where you’re starting from and chart out a route.

Maybe you like to know

- exactly where you’re going,

- how you’ll get there,

- what you’ll see and do along the way.

Or perhaps you’re somewhere in between these extremes.

Your plan (or a lack of it!) only matters in how you’ll define the return you expect from your investments.

Maybe you’ve told yourself:

“I have 2,50,000 – and I want to make 50 lakhs (5 million) in the next 10 years!”

Or:

“I have 25,000 now – and I want to have 1 crore (10 million) within 15 years!”

The BIG question to answer, though, is:

WHY?

Remember that we talked about how money is inherently worthless… and gets its value ONLY from what you can exchange it for?

That lies at the heart of your investing strategy and plan.

Before you draw up your plan, make sure you’re doing it for the right reasons.

Know what you’re going to exchange your money for.

Understand WHY you want money.

Once you’re clear about WHY you want a specific sum of money by a certain date, you can make – and execute – your investment plan with confidence and energy.

Then you can answer that critical question:

“What RETURN do I want from my investments?”

Sometimes, you may be very clear about why you need money – but may not know how much you want.

“I’m struggling to make ends meet – I want to be financially free!”

“I live hand to mouth – I want to have more fun!”

Yes… but HOW MUCH do you need for that?

These may not be easy questions to answer. But it is important to take time now to address them.

They lie at the core of your investment strategy.

In fact, they are the heart of your financial, money-making life.

So get clear about this before making firm investment plans.

Your Dream Is Your Own

There are no limits to what you can achieve with the right plan and strategy.

- If you want a stable, steady income to cover your needs, it’s possible.

- If you want to make a small (or big) fortune by investing, it’s possible.

- If you want to be fabulously wealthy and unbelievably rich, it’s possible.

Just as long as you believe in your dream!

There are no limits or goals that are ridiculous.

Your investment plan can aim to take your wealth to

- 2 lakhs (200,000).

- Or 20 lakhs (2 million).

- Or 250 crores (2.5 billion).

- Or 25,000 crores (250 BILLION).

It’s all possible… with the right strategy and action plan.

Of course, the effort and resources that go into a bigger, more ambitious plan will be different.

But anything can happen – if you know where you’re headed.

And understand how to fill in any gaps in your plan.

Even the grandest plans begin with knowing a few simple things…

- Where are you NOW?

- Where do you WANT to be?

- By WHEN do you want to get there?

And here are some more things to get clear in your mind first:

- How much money do you have (or get or earn)?

- How much do you currently spend?

- What are you spending it on?

All of this is foundational to the process of investing.

Just as you cannot run before you learn how to sit, stand and then walk… you cannot succeed at investing your money unless you understand how you’re dealing with it right now.

And to help you understand that better, we’re going to briefly discuss something called…

BUDGETING

Budgets, be it for a household or an entire nation, mean the same thing.

They help you see – and achieve a balance between – cash that’s coming in (income) and going out (expense).

Clearly, if you’re spending money like a drunken sailor with very little income, you won’t have anything left to invest – and even lose what little you’ve saved up.

So an early step in your investing journey is to figure out where you stand right now, in a financial sense.

A budgeting exercise can help with this.

What exactly is budgeting?

There are many different styles and ways of doing it.

Here’s mine – in 4 easy steps:

- Record

- Analyze

- Prioritize

- Allocate

Essentially, that’s ALL budgeting is.

Record: Make a note of every expense and all income you earn in a simple notebook or computer spreadsheet. Leave nothing out.

Analyze: Periodically, review your record. See how much you earn and what you’re spending. Observe the kind of things you spend money on.

Prioritize: After a few months, you’ll know where your money is coming from – and where it’s going. Take a long, hard look at this information. And make tough decisions.

For example, if you see that your Starbucks habit costs you 400 rupees a day – and there’s a sachet of readymade coffee in your local supermarket that tastes almost as good, but only costs 20 rupees each – you could seize a chance to swap a 40 rupee alternative… for one that forces you to spend ten times more.

Of course, a visit to Starbucks may be the highlight of your life. In that case, a 10x spend is NOT unjustified. So look for something else to re-prioritize. You’re sure to find something in your notes.

Allocate: The best plans must be backed by action. So after you identify your priorities, allocate an amount of money to each category – and stick to it.

In a remarkably short time, this simple budget exercise will transform your financial life.

- You’ll have a clearer picture of where money comes from and where it goes.

- You’ll have confidence that you’re spending only where it matters most.

- You’ll have more of it left than before – to invest into your future.

For a simple 4-step process, that’s a huge payoff.

Right?

Okay.

So let’s talk about your investing plan next.

By now, you’ve probably understood (even without my having to explicitly tell you) that ‘investing‘ isn’t as much about money as it is about discipline.

Especially…

Mental Discipline

It involves controlling your impulses and urges to spend cash on everything that attracts you, but making informed choices that balance your immediate joy and fulfilment with longer-term advantages and benefits.

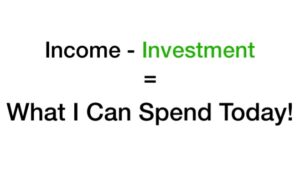

The best way to assign a sum of money for investment is not to first spend on everything you want to…

… but to allocate a portion of your available money while budgeting itself.

That way, your investments will grow regularly, steadily, and rapidly. Like your body on superfoods!

What’s even more fascinating (though it isn’t immediately obvious) is that you’ll get along just fine with what’s left!

So now that you’ve picked a certain amount of money to invest, it’s time to firm up…

YOUR ASSET ALLOCATION PLAN

You have all that you need to make a decision.

- You know about risk versus return on investment.

- You have an investment horizon in mind.

- You’ve got a clearer idea of what return to expect from investing.

Now all that’s left is to put it all together… into a PLAN.

But let me introduce you to an interesting philosophical question the world’s most famous and successful investor Warren Buffett asks:

“What if you could only trade 10 times… IN YOUR ENTIRE LIFE?”

Much of what we’ve talked about regarding ‘return on investment‘ presumes that we will EXIT an investment at some point in time.

By then, we want our money to have grown in value.

But Buffett’s question forces you to think hard about the kind of investments you’ll choose.

If you cannot exit from it, but have to leave your money invested for years and years, would it still be a worthwhile avenue to park your funds?

Will they grow – and keep on growing – if you did that?

Whenever the answer is “Yes”, you would have found something Warren Buffett might invest int… because he is the quintessential ‘buy and hold forever’ guy.

And his investments have grown steadily over the years. Berkshire Hathaway has posted average annual returns of 17.1% since 1985… well ahead of the broader stock market’s 10.5%.

If you had invested $10,000 into Buffett’s company in early 1985, your investment would be worth $2.4 million today!

So it isn’t idle musing when the Sage of Omaha asks:

“What if you could only trade 10 times… IN YOUR ENTIRE LIFE?”

Young investors like you should resist the urge to trade constantly – and think harder BEFORE sinking money into an asset.

That’s the key to long term success.

Match Your Plan To Your Risk Tolerance

None of this is prescriptive, just an indication of how a sample portfolio allocation might look.

Low Risk investor – needs to preserve capital

- 80% debt

- 10% equity mutual funds

- 10% gold

Moderate Risk investor – can risk some capital

- 50% debt

- 30% equity mutual funds

- 10% direct equity

- 10% gold

High Risk investor – has money to burn!

- 5% real estate

- 30% debt

- 45% equity mutual fund

- 15% direct equity

- 5% gold

But understand…

It’s ALWAYS a Fluid Situation

You should be watchful and prepare to make strategic changes as market conditions evolve.

With this background, you’re now ready to start exploring the several exciting investment opportunities that exist across various asset classes.

Once you see what’s available, you can cherry-pick those assets which match your risk profile and investing goals – to create your own investment portfolio.

Welcome to the WONDERLAND of Investments!

DEBT INVESTMENTS

Debt investments are fixed income options.

Your R.O.I. will depend upon the interest rate – and whether you’re paid Simple or Compound interest.

In simple interest, the interest is paid only on the amount you invest. In compound interest, you’ll earn interest on what you invest AS WELL AS the interest you earn.

So compound interest can grow faster over time, while the rate of growth of a debt investment earning simple interest remains constant.

How much interest will debt investments offer?

A bank will always be conflicted over the interest rates it offers.

On one hand, depositors want higher rates so that their deposits can earn more.

On the other hand, borrowers want lower rates so that their interest burden on loans is less.

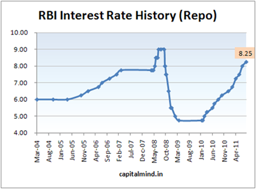

Interest rates vary from time to time.

A look at the RBI rate over a 7 year period looks like this:

How does this matter to you, as an investor?

Well, if you’re able to correctly predict which way interest rates will swing, you can suitably time your debt investments to take advantage of the cycle.

For instance, if you’re sure rates will be going up soon, you might invest in a short-term deposit – and when interest rate increases, re-invest in a deposit with a longer term to benefit from the higher return.

Real Return On Investment

With debt investments, because you know the interest rate being offered, you’ll have a clear idea of what R.O.I. you’ll get from your deposit.

However, there’s a spoiler waiting in the wings – determined to eat into your earnings.

And that’s our old friend… INFLATION.

Remember how inflation lowers the value of your money, so you’ll enjoy lesser purchase power?

That applies to interest on your debt investments, also.

So if you invest in a fixed deposit or bond with an 8% interest rate, and inflation is 5%, your REAL return on investment is (8% – 5%) = 3%

Real R.O.I. = Interest Rate MINUS Inflation

That’s not a lot.

So always factor in inflation while deciding upon your investments.

What Factors To Consider Before a Debt Investment?

We already discussed interest rate, but there are some other variables to take into account before choosing your investment.

- Interest rate

- Lock in period

- Payout frequency

- Tax benefits

- Transferability (secondary market)

… and the most important ‘X factor’

Lock in period

The lock in period is the duration of time for which your money cannot be removed/withdrawn from the investment.

If you buy a Govt. of India savings bond, your money will be locked in for 5 years. With Public Provident Fund (PPF), the lock-in period is longer… at 15 years.

Make sure you are aware of this duration. Otherwise, if you need to withdraw your money earlier, it may be difficult – and you may be forced give up some of your return.

Payout frequency

Payout frequency is a measure of the interval at which you are paid an interest or dividend on your investment.

Some debt investments pay out annually, some quarterly, and a few even monthly. And there are some (like PPF) that payout only upon completion of the entire 15 year term.

Tax benefits

Some types of debt investments offer tax advantages to investors. These are continuously changing. So be sure to stay informed about this advantage at the time you plan to invest.

Transferability

Mid-way through the period of an investment, you may want to withdraw your money for other needs.

With debt investments like bonds and debt mutual funds, you can do this by transferring your stake to another investor – and collecting your money.

SAFETY

For many risk-averse investors who park their money in debt investments, safety is the most critical factor.

Some are pensioners who live off the interest (or other return) on their debt investments. Others have limited incomes and supplement it from a steady R.O.I. on debt investments.

If they lose all (or part of) their capital, it could be a big problem. So capital preservation is a high priority… even if it comes at the cost of a smaller R.O.I.

Debt investments are typically safer than equity investments.

This is because these investments are the equivalent of collecting rent on your money. You’re not taking any risks on the performance of a business or the value of an asset.

So before putting your money into a debt investment, look at:

- Credit rating – Several professionally-run rating agencies carefully analyze the stability and credibility of debt investments, and rate it as being high-grade (safest), medium-grade (quite safe) and low-grade (mildly risky).

- Insurance – Bank deposits are protected by deposit insurance schemes, which in the case of Indian banks will safeguard your deposits upto 500,000 (five lakhs) rupees.

- Sovereign guarantee – Some forms of debt investment like government bonds and treasury bills are backed by the national government and are very safe.

- Institutional profile – For fixed deposits and other bank debt investments, public sector banks are usually the safest, followed by well-managed and long-standing private banks ranking next in safety.

Now that we’ve broadly analyzed the pros and cons of debt investment, it’s time to look at specific options and choices that you have to invest your money in debt.

Debt Investment Options : Post Office Schemes

In India, there are several debt investment options – and many of them involve an entity that many new investors may not even associate with personal finance and investing.

If you’ve thought the Post Office is merely a place where letters are sorted and parcels shipped all over the country, then… think again.

There are a host of debt investments managed by the Post Office including:

- Fixed or Term Deposits

- Recurring Deposits

- Monthly Income Scheme

- Senior Citizen Savings Scheme

- Kissan Vikas Patra

- National Savings Certificate

- Sukanya Samriddhi Yojana

After a brief overview of them, we’ll take a closer look at just one of them.

Fixed or Term Deposits:

You make a one-time investment of your money for a certain term or period, and are paid a fixed interest rate which is announced when you open the deposit.

Recurring Deposits:

You invest instalments of your money at intervals of a month, over a certain term or period. You are paid a fixed interest rate on the accumulated amount in your deposit.

Monthly Income Scheme:

You invest a chunk of money for a fixed period of 5 years, and your deposit earns a flat interest rate over the term – but this is paid out in equal monthly instalments. This offers depositors a regular monthly income for their needs, a debt investment ideally suited to those who can rely on this regular cash stream to meet their day to day expenses.

Senior Citizen Savings Scheme:

This is a special form of the Monthly Income Scheme above, but designed specifically for senior citizens (older than 60 years of age) – and paying a slightly higher rate of interest. It was designed especially for pensioners who need safety and security for their capital, along with a regular monthly income to cover every day expenses.

Kisan Vikas Patra:

KVP is a kind of bearer bond where investors purchase certificates for a pre-specified period of deposit – at the end of which they will receive double the amount they invested. Clearly, the rate of interest can be calculated based on the duration of the deposit. This is currently 10 years and 4 months – which works out to an interest rate of 6.9%

National Savings Certificate:

NSC is another bond investment similar to KVP that offers a fixed interest rate (currently of 6.8%) over a 5 year term – along with some tax advantages for deposits.

Sukanya Samriddhi Yojana

SSY is a scheme designed for welfare of a girl child, aimed at providing a means of saving towards a girl’s education. It offers a variable interest rate (currently 7.6%) on subscriptions paid into the depositor’s account.

And finally, there’s a jewel in the crown of Post Office debt investments…

Public Provident Fund

A special form of debt investment that any young investor would do well to carefully consider – and maximize ahead of any other option – is the Public Provident Fund, also known by its acronym of PPF.

There’s a good reason why so many investment advisors wax eloquent about PPF.

- Interest payment on PPF deposits is compounded every 3 months (you earn more)

- Deposits into PPF are allowed tax deductions (you pay less tax)

- Upon maturity, the proceeds are entirely tax-free (you keep more)

Throw in the added advantages of a completely risk-free debt investment that is backed by the sovereign government, and the advantages vastly outweigh the one drawback of PPF…

A 15 year lock-in period for your money.

But even this eventually works in your favor because the magic of compound interest acts on your investment – and you’d be hard pressed to find another option that gives you a better R.O.I., especially at such little risk!

No wonder the most savvy investors wish there were a higher limit for investing in PPF than 1,50,000 rupees per year.

Features of Post Office Debt Investments

Each of these debt investments have some unique features, but are broadly similar in that they

- offer stable, but modest R.O.I.

- are backed by the sovereign government, making them very safe

- allow flexibility to suit low- to middle-income citizens

- pay competitive interest rates

Procedural hassles of dealing with post office staff are a minor deterrent, with customer service often being worse than with banks and other investment agencies.

Before investing in any of these schemes, also make sure to learn more about the details.

Debt Investment Options : Bank Deposits

Instead of putting your money into fixed or recurring deposits in the Post Office, you could open the same kind of deposits in commercial banks.

The nature of your investment is similar, even though interest rates offered may vary slightly from one bank to another.

Not all banks are equal, so from the perspective of Credit Risk and Interest Rate Risk (which we discussed earlier), public sector banks are safest, followed by well-established and long-standing private banks with a good track record and reliable, trustworthy management.

Debt Investment Options : NBFC

Non Banking Finance Companies are similar to banks, but are unregulated and not required to comply with governmental guidelines.

This makes them far more risky than banks.

To compensate the bold investor for this risk, NBFCs often offer higher interest rates on deposits than banks.

Some NBFCs are of government agencies (e.g. Tamil Nadu Power Finance and Infrastructure Development Corporation Limited or TNPFC).

Others are private entities.

Regardless, these NBFCs are NOT backed by State or National governments, and default risk is a very real danger in investing with them.

Debt Investment Options : Corporate Fixed Deposits

Similar in nature to bank fixed deposits, corporate FDs invest your money directly with private firms and companies that need funds to run or grow their business.

Rather than borrowing from banks, sometimes companies choose to approach investors directly to lend them money. They offer higher interest rates than banks, but that is offset by the higher risk.

Corporate FDs in good, reputable companies may be reasonably safe. But as with any investment, do your research carefully and know the risks you are taking with your investment capital.

As with any financial investment, the resounding message is clear:

Caveat emptor – buyer beware!

Debt Investment Options : Debt Mutual Funds

We will discuss Mutual Funds in greater detail later on in this report.

For now, just understand that it is a debt investment option that lets you diversify your risk – by sharing your money across several different investments.

Debt Investment Options : Bonds & Debentures

There are many ways a corporation, business, or government can raise money to fund projects that expand infrastructure, grow manufacturing or scale up production.

One of them is to issue bonds.

Bonds are a kind of debt that promise to redeem investors’ money at the end of a specified period – while paying an interest on the amount borrowed for the duration.

Bonds are issued with

- a ‘coupon rate’ (which is the same as interest rate on a deposit),

- a redemption date (on which an investor’s money will be returned) and

- other relevant details like tax exemptions or discounts on investments

Bonds may be issued by

- governments

- corporations (private bonds)

Government debt instruments come in 3 types:

- T-bills

- G-secs

- Debentures and Bonds

T-bills (Treasury bills):

These are short-term notes issued by the government for which investors bid in an open auction. Each lot is huge and typically priced in crores (tens of millions) of rupees, making this an investment suitable only for bigger institutional investors.

G-secs (Government securities):

These are longer term notes that even retail investors can buy in smaller lots through various trading platforms or commercial banks.

Debentures & Bonds

These are bearer certificates issued to an investor with the promise of a rate of return over a duration of time. At the end of this period, the deposit will be repaid to the holder of the bond certificates.

Popularly known as RBI bonds, these are issued by the central bank from time to time, usually in response to the announcement of major public sector projects, or as part of a monetary policy intervention to mop up excess money in the economy.

Sometimes as an incentive to get people to invest in these bond issues, tax advantages are included – making an already good deal much better.

All forms of sovereign debt come backed by the guarantee of the national government, making them very safe and secure investments.

Private Bonds

Issued by corporations and companies, this “commercial paper” is similar to government bonds – with one serious exception… it is unsecured and not guaranteed by anything other than the company’s reputation and brand.

As an investor thinking of buying private bonds, you should consider two risks:

Security: “What if the company goes bust and cannot repay my money?”

Liquidity: “If I need my money back, how easy will it be to sell these bonds?”

Bonds can be either sold back to the issuing agency, or exchanged with other buyers on a trading marketplace. The price of buying and selling on such secondary markets will vary just like stock prices of a company.

How much you pay to own a bond on the secondary market will determine your R.O.I.

Which brings up an important question…

How Much To Pay For Bonds?

Like other forms of debt investments, with bonds you have all the information necessary to calculate your return on investment.

Knowing things like the interest rate and period of holding helps you compute the yield (R.O.I.) from investing in bonds.

If you purchase bonds directly from the government or company at the time it is issued, this calculation is simple and straightforward.

But when you pick up bonds from the secondary market, things get a bit more complicated. You will have to calculate something called the Yield to Maturity, or YTM.

Let’s say a bond issue is priced at 1,000 rupees with a 10% coupon rate and 15 year term.

If you buy this bond on the secondary market

- 5 years after it is issued,

- pay 1,100 rupees for it, and

- hold it until maturity

you will NOT get an overall 10% return – because you paid more than 1,000 for it, and held it for a shorter term.

You can use a formula to calculate YTM.

But as a smart investor, you must exercise judgment to determine your real rate of return – and then decide if the price is right to buy these bonds.

By choosing the right time to pick up bonds, you’ll get attractive prices.

Usually, whenever the central bank raises interest rates (making it more costly for businesses to borrow money), bond prices tend to decrease – and you’ll get a higher R.O.I. from buying then.

If this sounds vague and fuzzy, understand that this is just an overview of personal finance and investing, not a definitive ‘how to do it’ guide!

You still have to dive deep and learn more about an investment option before you’ll be ready to risk your hard-earned money on it.

If you feel bonds are the right debt investment for you, then go ahead and learn more about it – including YTM computation – and then put your money behind them.

It may take a few tries before you figure it out… but then, you’ll be off to the races!

GOLD

At this point, it seems apt to introduce one of the options that’s technically a physical asset, yet is often picked for investment because it’s a hedge against bad times.

I’m talking about Gold!

Although the price of gold fluctuates over time, by and large, it is considered to be a ‘safe’ investment (a hedge) that can cushion your portfolio against wild swings due to variation in price of equity stock holdings.

There are different ways you can hold gold. You can…

- wear it as jewellery

- hold it as coins or biscuits, ingots or bars

- gift it for weddings

- own it as bonds and ETFs

For investment purposes, gold jewellery is less than ideal because of losses from making costs, wastage, and difficulty in selling at a good rate.

So coins, bars and biscuits are preferred forms, though there’s an added cost and inconvenience in keeping it safe and secure.

Gold bonds and exchange traded gold funds are derivative investments that are backed by physical gold.

You can purchase bonds and shares that are held in electronic format in your account. The value of these shares tracks the market value of gold.

Okay, so now that we’ve discussed debt investments and gold, we’ll move on to the next asset class – equity investments.

EQUITY INVESTMENTS

In equity investing, you are BUYING a share or part of a physical asset – like a company, real estate or other commodity.

This is the essential distinction from debt investing, where you ‘rent’ your money for others to use. So while your return from debt is fixed, with equity investing you get to share in the growth of your asset in value.